Universal

Yield

Infrastructure

ABOUT CONCRETE

A suite of DeFi products powering secure, automated yield strategies and unlocking new opportunities.

Earn competitive rates of return with institutional yield opportunities.

Backed by

WHAT IS CONCRETE

Institutional grade on-chain infrastructure.

Generate yield for any asset. On any chain.

Vault deposits create composable yield-bearing tokens

Deposit

Get

Vault share

Earn

APY + POINTS

Use

ACROSS DEFI

Vault deposit tokens are usable across DeFi

EARN

BUILD

COMING SOON

CONCRETE MECHANICS

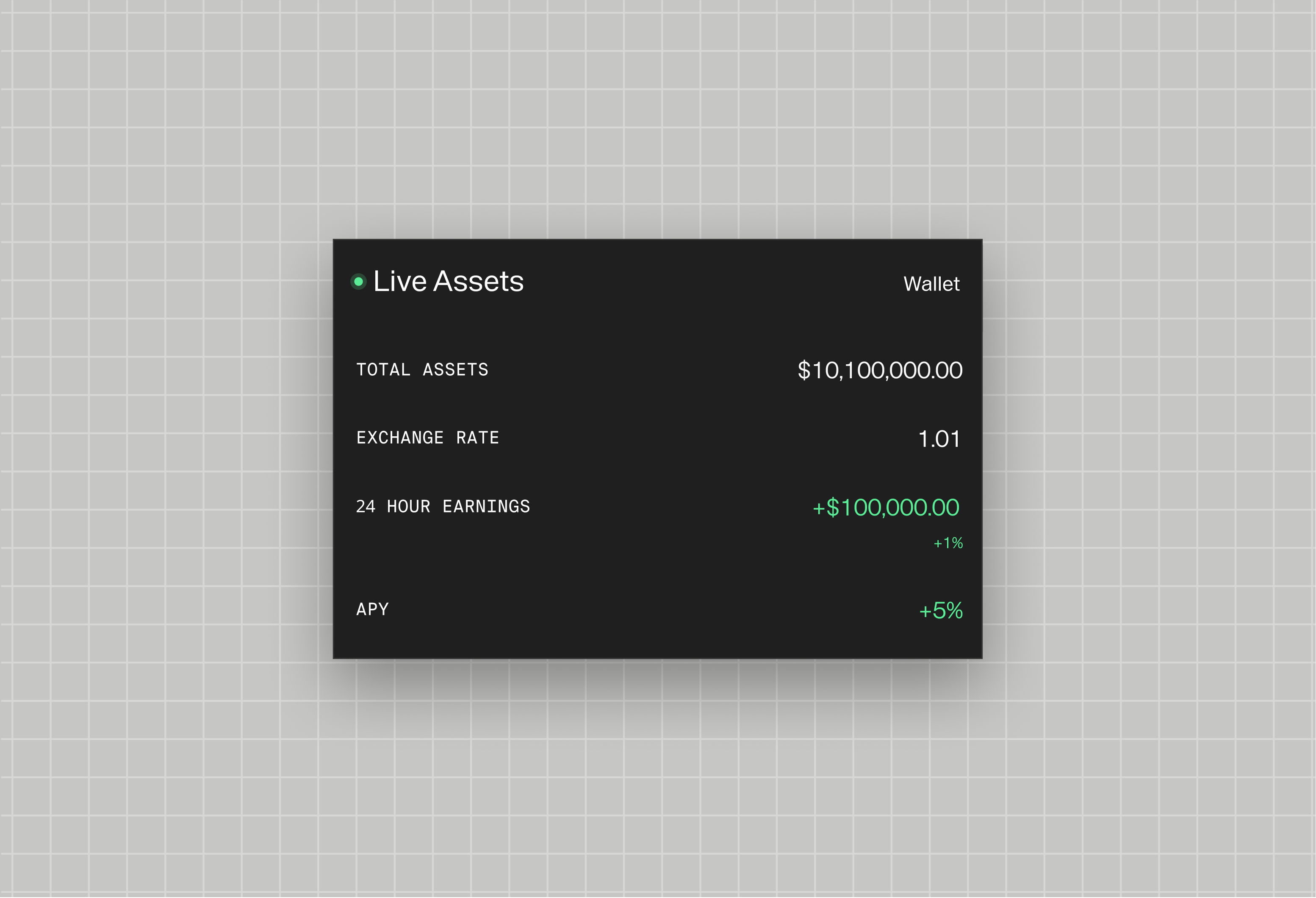

Earn

[1]

LPs enjoy competitive rates by Concrete's yield on autopilot system. Deposit assets, sit back and enjoy attractive yields.

[2]

Concrete Earn Vaults are powered by ERC-4626 and comprise of curated risk-adjusted strategies. LPs are given ct[assets] for their deposits as a yield bearing token representing their deposits and entitling them to revenues generated by vaults.

[3]

LPs receive ct[assets] which can be locked for boosted APYs and greater Concrete rewards.

CONCRETE MECHANICS

Build

[1]

Concrete Build is Concrete’s partner-facing platform for launching and managing earn vaults.

[2]

Build makes vault infrastructure secure, automated, and transparent so partners can bring strategies to market faster.

[3]

Concrete Build aggregates the very best of services — automations, accounting, security, and wallet operations — into a single platform.

CONCRETE MECHANICS

Coming Soon

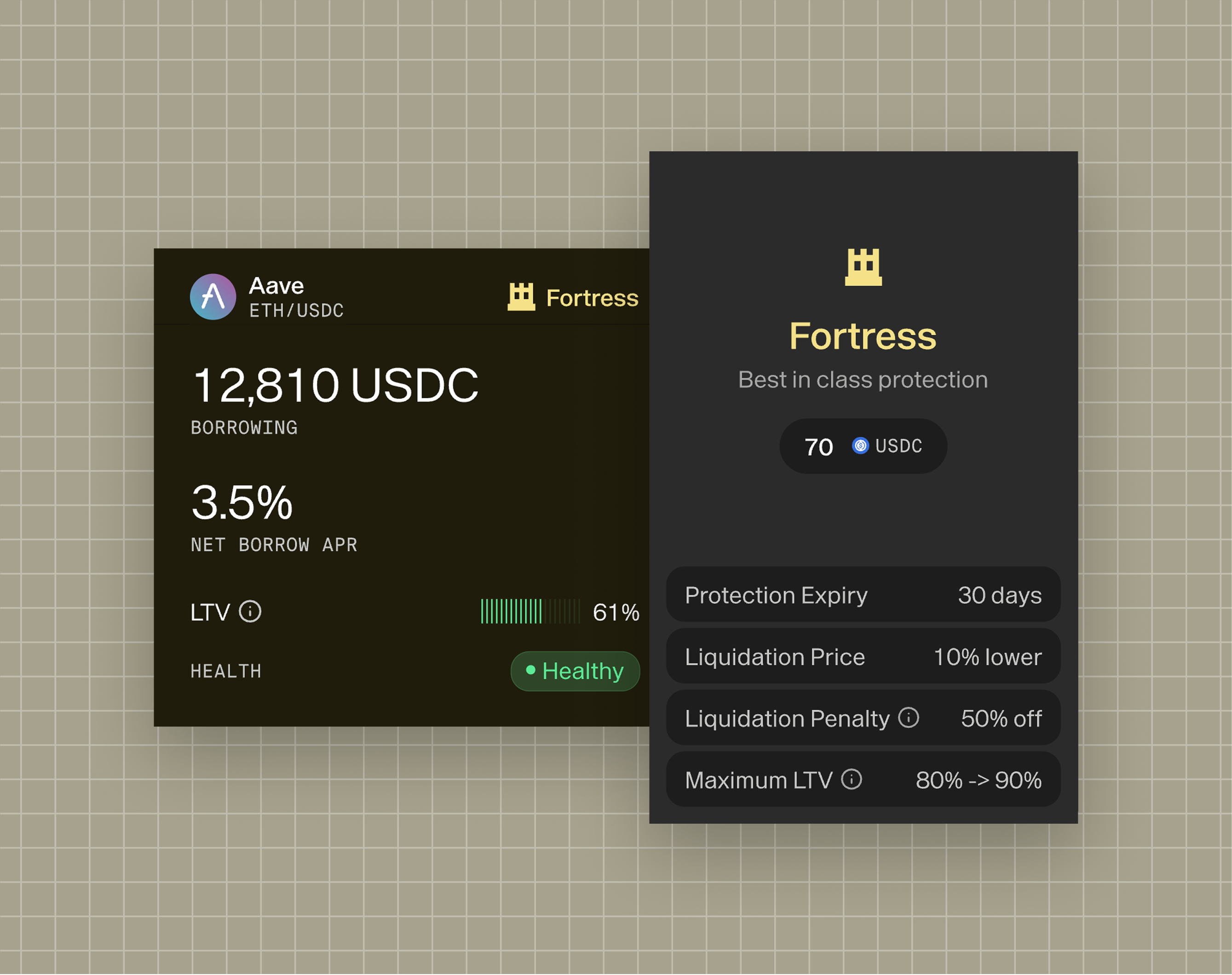

[1]

Borrow from your preferred money market through Concrete using Concrete's search to discover the best available rate

[2]

Protect enables liquidation protection for depositors, allowing for up to 3 times liquidation limits being exceeded for a deposit fee.

New Products

Coming Soon